Business model transformation

Business models are swiftly out of date. This array includes marketing, sales enquiries and shopping methods. Shifting commercial agreements, new industries, different suppliers and new brands are always disruptive. Fiscal pressure caused by falling store visitors and reducing margin is complicated by technical innovation and organisational flux. Shareholder pressure for high returns balance social pressures for environmental sustainability. A ubiquitous trend is integrating unique but essential functions to grow each separate business by mutual dependency, often labelled as ‘platformisation’. A customer waiting for a bus orders food via an app. The order is sent by an unseen telecom’s provider to an invisible caterer and paid for by an anonymous bank. The food is delivered by a bicycle and the entire service cycle is evaluated with a questionnaire app. All of these links offer an ‘open source’ platform by technology. Such adaptive business models were science fiction a decade ago.

To transform business models and successfully carry your staff on the journey one needs a deep understanding of the new dynamics, allied to the historical retail practices and flexible management.

Business model reworking

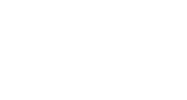

Darty, French market leader for white goods. Turnover more than €3.5 billion.

Challenge

In a digital disrupted market, Darty must offer customers a range of omnichannel choices but a new strategy is restricted by a business model set by sales via third-party sales. Company culture is historically a single ‘brand’ as a manufacturer selling to distributors and not to customers. How can the business remain profitable, adapt to these changes and retain staff loyalty?

Approach

1. Strategic guidance: definition of Darty’s new vision with modernisation built-in

2. Definition of the new commercial model

3. Definition of the 3-year transformation and business plan

4. Operational support for the store concept, service offers and development plan

Plan

An 18-month mission over several stages, from strategic to operational. Flexing with the appointment of Régis Schultz as new M.D., projects were maintained and contract was extended.

Results

1. Alignment of Directors by proof of concept to allay initial concerns.

2. Effective implementation of all recommendations.

3. Opening of the brand-new concept (Beaugrenelle) and deployment to the business park outlets within 18 months.

4. Improved revenue and profits. Asset sale to the FNAC for shareholder value that was unthinkable 2 years ago.

Strategic review and advice to investors

For investors, retail is a delicate investment. Like no other, it combines a pragmatic dimension (retail is detail: quality of the store experience, motivation of teams, etc.) and a breakthrough dimension (reinvention of models in the New omnichannel world), which are also difficult to model. However, numerous examples show that the sector remains a formidable creator of value, with champions like Maisons du Monde, Sephora, Adeo or Stokomani. But also exciting omnichannel models (AMPM, Mister Menuiserie…) or even more traditional players (Pacific Pêche, Chausson, Biocoop…). Diamart Consulting supports investors who want real insights, beyond “imposed figures”.

Strategic review of a specialised superstore brand

Jardiland, leader of garden centers (for banks then LGAM)

Challenge

Although the historic leader of garden centers, Jardiland experienced very difficult passages, before the spectacular revival of 2016-2018. The question posed to Diamart by the banks (renegotiation of the debt) then LGAM (majority shareholder, 2017) was simple: how to transform this commercial leadership into economic performance? How to quickly recover a company weakened by years of uncertainty with little Capex?

Approach

By combining consumer studies, internal diagnosis, data analysis and of course market review, Diamart confirmed the strong recovery potential of the company in a seasonal market but ultimately resilient and partially protected from competition from e-commerce. In close collaboration with management, we identified the priority profitability levers for the company and guided the action plans.

Plan

Short, intense missions, in "commando" mode to meet the tight schedules of investors - but taking the time to truly co-build with management and teams.

Results

The first mission for the banks formed the basis of the debt agreement that saved the company and laid out the roadmap for the new management. The second mission for LGAM confirmed the turnaround and made it possible to sell to In Vivo Retail under very good conditions.

Do you have a challenging project? Talk to us!

Our clients

We are very proud of the trust our clients have in our solutions.